Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

As a leading UK finance broker First Choice Finance have over 25 years helping people with a bad credit rating arrange loans, with friendly professional loan underwriters who are happy to discuss your needs and requirements

Unfortunately if you do have a bad credit rating this will impact on the interest charged, here at First Choice Finance we will attempt to minimise this, and make the loan application process as smooth as possible. Many high street banks and other main stream lenders reject loans from people with a bad credit score, First Choice Finance are a leading finance broker who gives our clients access to a large selection of secured loan lenders, many of which offer custom bad credit loan plans, by enquiring online to us we can guarantee that we will search our extensive panel and compare the different loans available to find the best loan deal for your circumstances.

What loan amount do you need

Secured loans are usually used for much great loan amounts usually £10,000, £20,000, £30,000 loans and upwards, a secured loan can be used for almost any purpose from consolidating your debts to adding an extension to your home. As well as being for larger amounts secured loans are often spread over a longer period of time, the longer loan term you choose the lower the monthly repayments but great the total amount repayable, are loan experts will be happy to go through different cost with you and answer any question you may have.

Secured loans are usually used for much great loan amounts usually £10,000, £20,000, £30,000 loans and upwards, a secured loan can be used for almost any purpose from consolidating your debts to adding an extension to your home. As well as being for larger amounts secured loans are often spread over a longer period of time, the longer loan term you choose the lower the monthly repayments but great the total amount repayable, are loan experts will be happy to go through different cost with you and answer any question you may have.How much can I borrow with a secured loan when I have bad creditHaving a bad credit history will have a negative impact on the amount you are able to borrow, but one of the most important factors is your properties current loan to value, if you have a small mortgage in relation to your property value this will allow you to borrow a much great amount, another factor is what other existing debts you have outstanding, in many occasions it may be able to consolidate your current debts into the secured loan helping you make your monthly repayments easier.

Can`t get a loan because of bad credit, try a secured loan

Video transcript

If you`ve struggled paying back loans or credit cards in the past and need to borrow more money now but cannot get personal loan, bad credit secured loans could be the solution.

Often when you go to get a loan, the first stop is unsecured loans, which usually rely on your credit history, so if that isn`t healthy you`ll likely either be declined or get very high interest rates on a loan, it may also be for too small an amount.

According to Aqua, the most common reason for being declined is not completing a previous payment agreement, with opening more than one bank account or having multiple credit checks in recent months also seen as negatives.

Not being able to borrow the money may be a worry for you, particularly if you want to ease your cash flow by utilising the loan to pay off your unsecured debts, such as credit or store cards, to leave you with a single repayment to make each month, which should result in smaller instalments, although you may pay more over the course of the loan due to interest payments.

Alternatively, there may be something that you really want to pay for, like home improvements to make your property more accessible or increase its value ahead of sale, and that`s another way where bad credit secured loans through First Choice Finance can come in useful.

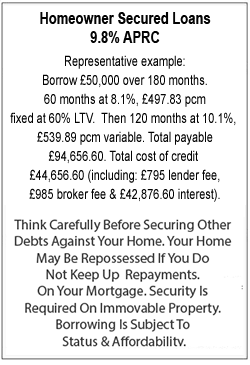

With our homeowner secured loans, impaired or bad credit needn`t be a problem as your property will be used as security for the lender and there are�many other factors taken into account, not just your credit history.�

So if you`re having trouble obtaining money from other sources, contact First Choice Finance today and get a quote on bad credit secured loans.

You can call us for free on 0800 298 3000 from a landline or call 0333 0031505 from a mobile, otherwise fill in our short on line form.

Adverse credit mortgage plans, an alternative to secured loans

Mortgages and remortgage may be available up to £1,000,000, even with an adverse credit rating, First Choice is a leading UK mortgage broker who can help give you access to many mortgage lenders. If you have adverse credit you could remortgage your house to release between £10,000 and £1,00,000 for debt consolidation, home improvements, a dream car or for that perfect holiday. We are dedicated to providing you with a mortgage or a remortgage which matches your needs even if you have an adverse credit rating.

You may feel that having an adverse or bad credit history limits your ability to find a new mortgage deal. We have mortgage lenders who specialise in adverse credit mortgages. If you`ve missed payments, have CCJ’s, defaults or any other credit problems, talk to them about the wide range of mortgage plans they have available.

Getting a new mortgage deal when you have an adverse credit history may be simpler than you think, we pride ourselves in providing straightforward fast decisions to applicants with bad or adverse credit ratings.

Working with many mortgage lenders throughout the UK and have a vast range of mortgage & remortgage plans available and they have a great deal of experience in the provision of adverse credit mortgages and can find a mortgage offer tailored to your specific needs

By using their extensive panel of lenders (many of whom specialise with mortgage plans and experience of arranging finance for people with current or past credit problems), we are often able to help arrange refinance mortgages for many who have been refused in the past.

Video transcript

If you`ve struggled paying back loans or credit cards in the past and need to borrow more money now but cannot get personal loan, bad credit secured loans could be the solution.Often when you go to get a loan, the first stop is unsecured loans, which usually rely on your credit history, so if that isn`t healthy you`ll likely either be declined or get very high interest rates on a loan, it may also be for too small an amount.

According to Aqua, the most common reason for being declined is not completing a previous payment agreement, with opening more than one bank account or having multiple credit checks in recent months also seen as negatives.

Not being able to borrow the money may be a worry for you, particularly if you want to ease your cash flow by utilising the loan to pay off your unsecured debts, such as credit or store cards, to leave you with a single repayment to make each month, which should result in smaller instalments, although you may pay more over the course of the loan due to interest payments.

Alternatively, there may be something that you really want to pay for, like home improvements to make your property more accessible or increase its value ahead of sale, and that`s another way where bad credit secured loans through First Choice Finance can come in useful.

With our homeowner secured loans, impaired or bad credit needn`t be a problem as your property will be used as security for the lender and there are�many other factors taken into account, not just your credit history.�

So if you`re having trouble obtaining money from other sources, contact First Choice Finance today and get a quote on bad credit secured loans.

You can call us for free on 0800 298 3000 from a landline or call 0333 0031505 from a mobile, otherwise fill in our short on line form.

Adverse credit mortgage plans, an alternative to secured loans

Mortgages and remortgage may be available up to £1,000,000, even with an adverse credit rating, First Choice is a leading UK mortgage broker who can help give you access to many mortgage lenders. If you have adverse credit you could remortgage your house to release between £10,000 and £1,00,000 for debt consolidation, home improvements, a dream car or for that perfect holiday. We are dedicated to providing you with a mortgage or a remortgage which matches your needs even if you have an adverse credit rating.You may feel that having an adverse or bad credit history limits your ability to find a new mortgage deal. We have mortgage lenders who specialise in adverse credit mortgages. If you`ve missed payments, have CCJ’s, defaults or any other credit problems, talk to them about the wide range of mortgage plans they have available.

Getting a new mortgage deal when you have an adverse credit history may be simpler than you think, we pride ourselves in providing straightforward fast decisions to applicants with bad or adverse credit ratings.

Working with many mortgage lenders throughout the UK and have a vast range of mortgage & remortgage plans available and they have a great deal of experience in the provision of adverse credit mortgages and can find a mortgage offer tailored to your specific needs

By using their extensive panel of lenders (many of whom specialise with mortgage plans and experience of arranging finance for people with current or past credit problems), we are often able to help arrange refinance mortgages for many who have been refused in the past.

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential