Call and speak confidentially to an experienced, qualified mortgage adviser about refinancing, they can talk through your specific needs and look to arrange a suitable remortgage or homeowner loan to help you get back on top of your cash flow.Here at First Choice Finance, we could set you on the road to recovery, even if you have been let down by another company we may still be able to help you.

Call and speak confidentially to an experienced, qualified mortgage adviser about refinancing, they can talk through your specific needs and look to arrange a suitable remortgage or homeowner loan to help you get back on top of your cash flow.Here at First Choice Finance, we could set you on the road to recovery, even if you have been let down by another company we may still be able to help you.

Credit Card Debt Consolidation

So what exactly is debt consolidation? The idea of consolidating your debts has been around since the dinosaurs (well, not quite that long but you get the idea!) It has stood the test of time because when used correctly it can provide a manageable solution for your debt problems. We have been finding our clients debt consolidation remortgages since we set up around 25 years ago and customers today are still enquiring about this option and see the potential value of it today. The idea is a pretty simple one. You take a number of credit debts, for example credit card, store card, personal loan, car loan, overdraft and so on and pay the balances off by moving them to a single, hopefully lower repayment. Please note you will pay more overall by extending the term of your credit. The theory is that by consolidating you aim to end up paying less each month and can take some pressure off your monthly household finances.Refinance Remortgage

In particular a debt consolidation remortgage can work especially well for credit card debt consolidation or a mixture of personal loans and store card consolidation by refinancing those debts into a more manageable monthly payment. You can often feel like you are paying over the odds just on the interest rates on many credit cards. If you take out credit on just a few cards and grow the balances this could mean that your bills keep escalating and if you are not careful may reach new heights that you never expected, or accounted for in your household finances.

In particular a debt consolidation remortgage can work especially well for credit card debt consolidation or a mixture of personal loans and store card consolidation by refinancing those debts into a more manageable monthly payment. You can often feel like you are paying over the odds just on the interest rates on many credit cards. If you take out credit on just a few cards and grow the balances this could mean that your bills keep escalating and if you are not careful may reach new heights that you never expected, or accounted for in your household finances. Credit cards are often used for short term finance and can be helpful to fund something essential and enable you to pay it back over a slightly longer period, but many people fall into the trap of using them for long term finance only ever making the minimum repayment. Even if you cut them up and stop using them your existing balance can continue to run up. Consolidating your credit card debts into a remortgage may let you re-structure the debt and can enable you to pay down the debt instead of leaving it in place.

Take Control of Your Finances

However if you can make cuts elsewhere to get on top of those credit bills then that could be a faster way out overall . So look at your outgoings carefully, find out where the money is going. If you cannot make budget adjustments to get on top of your finances and decide to use a debt consolidation remortgage to borrow enough money to pay off all (or most) of your credit card, personal loan and store card debt at once then you can speak to us without any obligation and in confidence on 0800 298 3000 (landline) or 0333 0031505 (mobile). Alternatively fill in our short on line enquiry form and we will get back to you. No more minimum payments every month. You may even be suited to a fixed rate mortgage so you know exactly what you are paying and for how long. Take the first step to breaking the negative cycle of debt problems and give us a call.Benefits to Debt Consolidation Remortgages

Not only for credit card debt consolidation, debt consolidation remortgages can provide many benefits for any kind of debt consolidation be it, secured loans, personal loans, guarantor loans, car finance, credit cards, store cards, the list goes on. Here are a few of them:- Consolidate your debts into one affordable manageable payment

- Save money on some high interest rates on unsecured finance

- Free up cash that could be used on other projects

- Make your finances simpler and less stressfu

Potential Risks Involved with Debt Consolidation

As with anything in life you should always weigh up the positives and negatives. Here at First Choice Finance, our expert advisers are here to help you decide what to do and strike just the right balance. In the meantime read below for some of the aspects involved with debt consolidation remortgages and mortgages that you should consider:- Converting debt to secured debt needs careful thought due to risks

- You could end up paying more overall depending on rates and terms

- It is important not to keep overspending or your troubles will get worse

- Only borrow what you really need and make sure you can afford the payment

Homeowner Loan or Buy to Let Instead?

If you have considered all the pros and cons and still see the value of debt consolidation remortgages but have a great rate on your existing mortgage. Well, it isn`t always the end of the road, if you so wish we will do all we can to give you another option that still has all that you are looking for. We want to help you and sometimes you just need a little assistance from our resourceful and creative staff to show you another route to your end goal of improving your cash flow and taking control of your finances.For example we could look into arranging a debt consolidation loan for you. It`s similar to a debt consolidation remortgage in that it can still restructure your finances but rather than replacing your mortgage with a new one it will just sit behind it as a second charge. These have been around for a long time and are most commonly used for refinancing existing credit or for home improvements, sometimes referred to as homeowner loans they can in fact be used for virtually any purpose. Amounts available range from £3,000 to £100,000 and terms are available between 3 and 25 years to match your budget.

Or if you are lucky enough to own a Buy to Let property we could look at taking out debt consolidation Buy to Let remortgages on that property rather than your own home. For more information on Buy to Let property mortgages give us a call, enquire on line or take a look at our pages on Buy To Let.

As you can see the paths available to you for debt consolidation could be many and varied. So even if you think you are at a dead end, talk to us or complete the short on line form and you can talk through your requirements in confidence to our in house experienced finance specialists.

How a mortgage can be used to consolidate your debts

Video transcript

If your unsecured or secured loan debts or credit are mounting, you could look into taking out a debt consolidation mortgage to help put you back onto a more stable financial footing.Office for National Statistics figures show that wages aren`t keeping up with inflation, so people are more inclined to borrow in order to maintain their existing way of life.

However, if this spending isn`t kept in check, it could lead to a descent into a debt spiral, as people make further unsecured borrowings to pay off previous debts and maintain life style.

A debt consolidation mortgage can set you back on the right path, and effectively draw a line under your credit and personal loan borrowing, so that repayments don`t get away from you.

Key is you have to budget better once you go through this loop, as it is not something you can keep doing. So some lifestyle adjustments may be necessary.

With this kind of home loan, the equity in your property would be used to pay off things like personal loans, credit cards and store credit, leaving you with a single payment to make each month.

Not only is this easier to keep track of, but it should also mean repayments are smaller.

Bear in mind that you need to look at the total amount paid back on when consolidating debts as you may pay back more over the term.

So aim to keep the term as short as you can whilst making sure you can afford the repayments.

To identify a suitable debt consolidation mortgage for you, you should consult First Choice Finance and let us use our long experience to back you.

As part of our support we will provide you with a no-obligation free personal illustration that you`re free to turn down if you just don`t feel like going ahead, contact us today – fill in our short enquiry form or give us a call when you are ready to get some realistic figures to ponder.

Get 90% LTV Mortgages - 90% LTV Available on Selected Mortgage Plans - Enquire Online.

Return to the video homepage

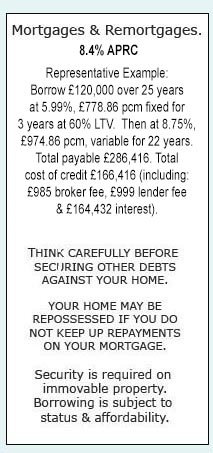

Mortgages & Remortgages |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential