Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

What determine`s what mortgage rate I will receive

- Loan To Value (LTV) - Your loan to value is a factor used by many mortgage lenders to determine the mortgage rate you will receive, usually the lower the LTv the lower the interest rate you will be charged

- Credit Profile - If you have existing debt or an existing mortgage then your payment history is a factor used by mortgage lenders, if you have missed payments on credit cards, loans or have mortgage arrears then you may have been declined for a mortgage or the cost may be higher, if you have a poor credit rating we still may be able to help you find a new mortgage, First Choice Finance give you access to specialist bad credit mortgages enabling our mortgage advisers to find mortgage for people with bad credit histories.

- Existing Debts - A important factor is your mortgage affordability, if you have existing debts you may need to consolidate your debts into your new mortgage, First Choice Finance are able to offer you a range of debt consolidation mortgages allowing you to restructure finances

Getting A Mortgage

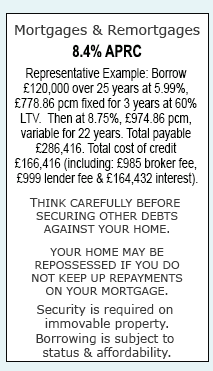

First Choice Finance help you throughout the mortgage / remortgaging process, from starting the search for the best mortgage rates available for your circumstances, to arranging property valuations, talking to mortgage lenders, and processing the mortgage to ensure you get the mortgage approved and money for your mortgageMortgages & Remortgages |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential