Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

In any of these positions it is key that you try to find the best mortgage deal. The right mortgage product can often save you £1000s over the term of a mortgage. High street banks and lenders out there have some great plans but they are limited to offering their own lending rates and deals, which may not necessarily be the products that are best for you. That is why mortgage brokers and mortgage companies can come hand in very useful, a mortgage broker or intermediary work closely with lots of mortgage companies, and in the case of First Choice Finance will will give you no obligation advice and recommend a mortgage tailored to you through a free no obligation personalised illustration. Furthermore with a quarter of a century of experience we should know the industry inside and out by now. Call us on our mobile friendly number 0333 003 1505 or if you are calling from a landline use 0800 298 3000 to find out our panel of mortgage companies very latest deals and products currently on the market.

In any of these positions it is key that you try to find the best mortgage deal. The right mortgage product can often save you £1000s over the term of a mortgage. High street banks and lenders out there have some great plans but they are limited to offering their own lending rates and deals, which may not necessarily be the products that are best for you. That is why mortgage brokers and mortgage companies can come hand in very useful, a mortgage broker or intermediary work closely with lots of mortgage companies, and in the case of First Choice Finance will will give you no obligation advice and recommend a mortgage tailored to you through a free no obligation personalised illustration. Furthermore with a quarter of a century of experience we should know the industry inside and out by now. Call us on our mobile friendly number 0333 003 1505 or if you are calling from a landline use 0800 298 3000 to find out our panel of mortgage companies very latest deals and products currently on the market.What Is A Mortgage Company?

One definition of a mortgage company is an entity that deals in originating and/or funding mortgages for residential or commercial properties. It is often the case that although a mortgage company quite markets the products available, they have investors behind the company that actually fund the loan. Mortgage companies can be differentiated from one another by the internal underwriting standards or the products offered and include banks, investment businesses, specialised licensed lenders, building societies, mutuals and private equity firms.

One definition of a mortgage company is an entity that deals in originating and/or funding mortgages for residential or commercial properties. It is often the case that although a mortgage company quite markets the products available, they have investors behind the company that actually fund the loan. Mortgage companies can be differentiated from one another by the internal underwriting standards or the products offered and include banks, investment businesses, specialised licensed lenders, building societies, mutuals and private equity firms.If you have saved enough for a deposit, mortgage companies can provide the loan to buy that house that you have been after to get your dream home or escape your parents�.

UK Mortgage Companies

The recent subprime mortgage crisis of 2008 and subsequent wide scale recession caused many mortgage companies to go out of business, not only in the UK but also on a worldwide level. As a result the amount of mortgage companies in the UK drastically fell and consequently so did the products available, lending criteria narrowed substantially. Fortunately as the market continues to pick up so are the companies willing to lend on mortgages and new secured loan (second mortgage) and mortgage companies are entering the market, including ones looking to provide mortgages and remortgages for consumers with adverse or poor credit.Of those mortgage companies that still operate many exist on a nationwide basis for example, big high street banks like Halifax, or NatWest. However there are some, like the Vernon Building Society that operates in their local area for and prefer to cater to their local clientele and will provide products on a particular radius only. We have access to most lenders in the market to help you decide which mortgage lender would be best suited to you.

Mortgage Companies For People With Bad Credit

Here at First Choice, as a finance company and mortgage adviser we have many close standing relationships with many established lenders that offer products for people with bad credit. Many of these do not deal with the public directly, instead they rely on specific businesses, like First Choice Finance, to sort the mortgages for their target customers directly. If you have existing adverse credit, such as defaults, county court judgements, mortgage arrears or are in debt management you may have experienced how difficult it is to obtain credit. If sounds like you, feel free to give us a call or fill in our short form and we will tell you without any obligation if we can help.Mortgage Companies and Mortgage Brokers

Here at First Choice we have access to a lot of lenders who should be representative of the whole of market so that our customers are not confined to a limited range of a products from a particular high street bank or mortgage company. When a mortgage broker works closely with and knows which mortgage companies are lending to you, it can increase the chances of you securing a good deal for your circumstances.Our in house mortgage advisers are able keep abreast of recent developments in the market and research new products on a daily basis to ensure we are able to serve you properly to the level you would expect in the mortgage sector. As a result, our customers could even benefit from saving crucial time and money. We use our in depth market knowledge and leading edge sourcing system to find the best deal in a fraction of the time you might expect and have access to products that might not normally be readily accessible to you. If you want to research the mortgage type you are after with regard to the product types available head over to our page on mortgage types . Better still fill in our short online enquiry form and your personal mortgage adviser will get back to you with an idea of rates and products.

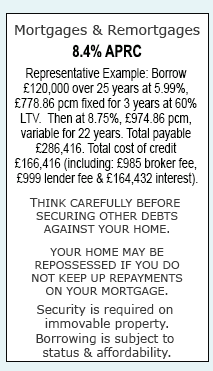

Mortgages & Remortgages |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential