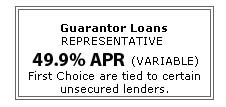

Guarantor Loans To Suit Your Budget With Affordable Repayments And Use The Money For Any Purpose

Guarantor loans for £10,000 can be a life changing amount and can help to avoid extra fee`s and costs that may be involved if you take out numerous loans in a short space of time rather than just the one for the larger amount you require. If you have a guarantor ready to vouch for your loan then don`t waste any further time and contact us on our mobile friendly number at 0333 003 1505 or our free phone number 0800 298 3000, alternatively complete our short on line enquiry form and we can give you access to guarantor loan lenders which do not just rely on your credit history and may advance up to £10,000.

Guarantor loans for £10,000 can be a life changing amount and can help to avoid extra fee`s and costs that may be involved if you take out numerous loans in a short space of time rather than just the one for the larger amount you require. If you have a guarantor ready to vouch for your loan then don`t waste any further time and contact us on our mobile friendly number at 0333 003 1505 or our free phone number 0800 298 3000, alternatively complete our short on line enquiry form and we can give you access to guarantor loan lenders which do not just rely on your credit history and may advance up to £10,000.Guarantor Loan For £10,000 - The Basics

(As with any finance criteria changes so please check for up to date requirements)

- The borrower can spend the money as you wish, get from £1,000 to £10,000.

- Reasonable interest rates compared to subprime, doorstep or payday lenders.

- Terms range from 24 months up until 72 months for a £10,000 guarantor loan.

- No upfront fees, any fees for the loan are added to it and are included in the APR.

- You need be able to show some kind of regular income.

- Must be 18 or over and a UK resident in England, Scotland or Wales.

- Must have a UK bank account and not currently be bankrupt

- Must be 21 or over (and under 72 when the loan is due to end).

- Must have fair or good credit themselves and not be bankrupt or in an IVA

- Must be a UK Homeowner or a mortgage payer.

- Can be anyone who is willing e.g. Family member, friend, work colleague.

- Cannot be financially linked to you through a joint bank account, joint credit card etc

Borrowing from £1,000 to £10,000 via Guarantor Loans

The amount that you are looking to borrow on a loan will inevitably vary from case to case. If for example you are looking for a guarantor loan because you have been rejected by other personal loan lenders due to less than ideal credit, the first matter is to establish how much you want.A small loan of £1,000 could be enough to pay off your outstanding credit card and help to get you back on top of your finances so that you can start to repair your credit position. Fortunately guarantor loans sit at a crucial point in the loan market with flexibility being a huge benefit and as a result have many key uses, not just for those with poor credit or for those who need small amounts. If you have no existing credit a lender may struggle to determine your history of how you pay your outstanding debts, this doesn`t necessarily mean that you have bad credit but it may mean that you are rejected by conventional personal loan lenders. A guarantor loan of £10,000 would be enough to take on a large scale home improvement project or clear some serious credit card or store card balances and may help a future lender to see that you pay your debts on time and in full. For more information on the amount you can obtain with our guarantor loan lenders, simply fill in the short on line form at the top right of this page or give us a call from a mobile on 0333 003 1505 or 0800 2983000 from a landline and our in house team can talk through what you are looking to achieve.

Online Guarantor Loans

No matter the size of the guarantor loan you are after, we understand the importance of getting the finance through smoothly and efficiently. Whether it is guarantor loans £10,000 or £1,000 it does not affect how your enquiry is handled as we value all of our customers enquiries, regardless of the amount you require. If you are ready to go, so are we, if not and you would like some more information on guarantor loans then read our key points page help with guarantor loans.Homeowner Loans For £10,000

A guarantor loan of £10,000 can be a great option and a substantial amount of money to borrow but it is crucial to realise that it might not be your only option. While we are not in the business of discouraging a guarantor loan if that is what you want, we do want to make sure that you fully understand all of the options available to you. We wouldn`t want you missing out on a good deal after all. Thankfully you don`t have to worry about that, our experienced finance advisers can take a look at your needs and circumstances to give you an idea of your options through us if you do not want or cannot obtain a guarantor loan. For alternative loans in particular we have competitive homeowner secured loan plans suited to good, fair and poor credit. As the loan is secured against your property as per the previously termed second mortgage product, we can achieve terms of up to 25 years and amounts of up to £100,000. However these loans are second charge mortgages and carry the same risk as a mortgage - so please think carefully before securing other debts against your home, your home may be repossessed if you did not keep up repayments on your mortgage. For more information read about our homeowner secured loans or call the loans team on the above number, alternatively fill in the short form and we will call you.Guarantor Loans |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential