Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

Our buy to let mortgage calculator can go a long way to helping you figure out what your payments may look like and what impact it could have on your budget. Try out our >> loan & mortgage calculators. Once you have the numbers in front of you, if you would like a free personal illustration from ourselves please call us on 0800 298 3000 (landline) or 0333 003 1505 (mobile friendly) to speak to one of our in house mortgage advisers who can calculate the cost of your buy to let mortgage, or start our 1 minute enquiry form at the top right of the page.

Buy To Let Mortgages Explained

Buy to let mortgages have some significant differences from their conventional cousins. One of the most important differences is that with a buy to let mortgage a lender will take into account the anticipated rental income of the home, amongst other things. Some will work on an expected rental income from the proposed property being no less than 125% of the mortgage repayment, of course if you have a reasonable deposit and we find you a low cost buy to let mortgage then that box should be ticked fine. If for example, your mortgage repayment is £450 then your monthly rental income would ideally be around £575. The mortgage repayment calculator in particular will allow you to calculate your mortgage payment and how much rental you would need to be accepted for a buy to let mortgage.

The mortgage repayment calculator in particular will allow you to calculate your mortgage payment and how much rental you would need to be accepted for a buy to let mortgage.Another Important distinction is the amount of deposit you will require. With a buy to let mortgage the minimum deposit that is required is 20-25% depending on the lender. However it is believed that the home buy scheme or similar may well be available for landlords shortly which means you could get a second home on board at deposit levels of around 10%. This is still more than a 5% deposit to purchase a residential property which some mortgage lenders may offer for example, but not a million miles away. As we give free no obligation quotes and have access to multiple plans in any case then there you might be just as well to give us a call and find out what the latest options are for you in any case. If you use our loan to value (LTV) calculator it will even tell you the amount of deposit that will be required for the price of the letting property you are looking to purchase at a given LTV.

Buy To Let Mortgage Calculator How Much Can I Borrow?

How much you can borrow for a buy to let mortgage depends on a number of things. The amount of deposit and rental income has an impact as we have already established. Along with that the affordability of the loan is of prime concern to the lender, this buy to let mortgage should be a solid investment for both you and the lender. We all want a `win win` situation. In addition lenders will often want you to have landlords insurance to avoid legal issues and you may want to get rental insurance to cover your mortgage payments if you have a period without tenants. If you have established some basic figures with our buy to let calculator or just want to explore some of the rates available please call us on the above numbers or fill in the on line form.Top Tips For Buy To Let Mortgages

Here are a few tips to consider when you are looking at venturing into the buy to let market:- Research the market and choose an area where your target tenants live. E.G. Near a university if you want students or near a school if you want families.

- Think about your target tenant and how hands on you are wanting to be as a landlord. Do you want top pay a letting agent a slice of your fee or run the tenancy yourself?

- Make sure you are getting a suitable buy to let mortgage. We suggest going to a reputable business who has experience to help you.

- Finally and most importantly, be happy with the numbers to ensure that this is going to be worth your while before you finally agree to the mortgage. Our buy to let mortgage calculator can help you do this.

Interest Only Buy To Let Mortgage Calculator

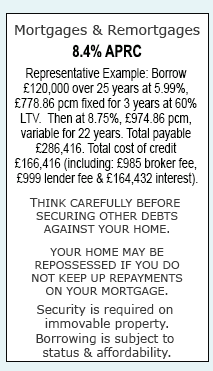

An interest only mortgage on a buy to let can be an effective way of keeping your monthly mortgage repayments low, all the while maximising the return on your rental income. Once the mortgage term is over you can either come back to us to look at a remortgage, or alternatively sell your property and use any equity from the sale to purchase another buy to let or spend as you see fit. If you would like to compare your monthly return with an interest only mortgage to a repayment mortgage use our buy to let calculator, more specifically the mortgage repayment calculator which will show you the mortgage payment for both repayment and interest only for any rates you may want to try.Mortgages & Remortgages |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential