No one can predict the future, and it can be tricky to anticipate when your business will need that extra helping hand, business loans can be arranged swiftly and efficiently so your company doesn`t have to feel the pinch, especially in times of economic uncertainty, or lose out if big orders come in but you need to be able to enhance your facilities or cash roll raw materials to take that business on. For more information regarding a loan for your business, contact our offices on 0333 003 1505 (mobile friendly) 0800 298 3000 (landline) or through ouron line enquiry form where we can help provide you with access to competitive business loans, alongside free quotations before you make any decisions.

Business Loans Explained

Business loans are available for a whole host of different companies in differing market sectors and can be a vital aide for businesses large and small. When it comes down the bare basics a business loan is funding given to a business by a bank or specialist lender to be repaid by a certain date, with an interest level agreed. Essentially a business loan is the same as a personal loan, the difference being that the money is paid to a business rather than an individual person and should be used to benefit the company accordingly.

Business loans are available for a whole host of different companies in differing market sectors and can be a vital aide for businesses large and small. When it comes down the bare basics a business loan is funding given to a business by a bank or specialist lender to be repaid by a certain date, with an interest level agreed. Essentially a business loan is the same as a personal loan, the difference being that the money is paid to a business rather than an individual person and should be used to benefit the company accordingly.Uses For Business Loans

A loan for a business could be used for a very wide number of reasons:

A loan for a business could be used for a very wide number of reasons:- Purchasing new equipment: If you are looking to expand and employ new personnel the chances are you will need to purchase new devices to go along with them; computers, furniture, machinery, the costs all add up.

- Business expansion: Moving to new offices involves many costs you may not expect, aside from the increased cost of a bigger space, re-directing post and phone numbers for example, may be something you haven`t factored into the move.

- Restructuring company cash flow: If you have money tied up in business investments it can be hard to ease the cash flow where it is needed.

Business Loans Interest Rates

The interest rates that business loans usually carry can vary significantly and is often largely dependant on your particular business model and the industry you are involved in. Due to the nature of the loan being used for business purposes the lender will want to assess your business model, accounts and credit risk to ensure that the business itself will be able to sustain paying the loan back over the agreed repayment period. For more information on the rates involved with business loans and your business specifically, give us a call on 0800 298 3000 (landline) or 0333 003 1505 (mobile friendly).Bad Credit Business Loans

Whilst having bad credit can make getting a loan much more difficult, it is possible to raise finance with a less than ideal credit history. With business loans in particular there are opportunities for you to show a lender that providing your business with the money is a safe bet. Whilst your rates may be slightly higher, if your business has substantial assets or a particularly good business plan a business loan lender may still be willing to loan you the money. To find out if you will qualify for business loan through our sources, apply online in the top right corner or give us a bell and one of our loan team will get back to you.

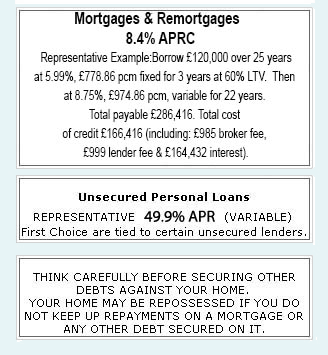

|

|

Unsecured Personal Loans |

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST

YOUR HOME. |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential