Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

The repayment term for the loan can weigh heavily on whether it is affordable and thus whether the loan is the right move for a person. This is more of a factor with larger amounts as the payments may just be too much to cope with over a just a few years.

For some of us, a long term loan could constitute a personal loan repaid over two or three years and so compared to a payday loan that should be repaid only weeks after you take out the loan, it could be considered long term. Generally though, a long term loan would be some type of secured loan or mortgage that can allow a repayment term of up to 35yrs - as long as it fits with other criteria stipulated by the lender. By having a longer term to repay your loan the repayments can be decreased and you can hopefully afford to raise the larger amount that you require for your scenario.

There are a number of secured loan products available but opting for a loan type, like an `any purpose loan` widens your horizon on the uses of long term loans and often allows you to utilise the capital raising in more efficient ways.

There are a number of secured loan products available but opting for a loan type, like an `any purpose loan` widens your horizon on the uses of long term loans and often allows you to utilise the capital raising in more efficient ways. Secured loan volume in the UK has recovered slightly over the last year or so and is probably nearing the £50 million pounds a month, so consumers are using this type of loan to get the money they require. Secured loans on average are larger than unsecured loans, so less actual loans will see more volume of money being lent.

So if you are going to look into secured loans what exactly can they be used for?

Enhancing your home through a new bathroom, kitchen, conservatory or a makeover is one well know use of large secured loans. The fact is in modern times these home improvement projects are expensive and so being able to spread the cost over longer periods may make your project viable.

Raising money for debt consolidation is often a popular use, if you have numerous high interest credit cards weighing down on your household finances; it is easy to let the debt escalate, especially if you can only maintain the minimum payment on each loan. By taking out a larger long term loan you can spread the payments over an affordable term and actually start to cut down on your monthly outgoings, the key thing is to put yourself in a better cash flow position.

Aside from refinancing or extending your house, a large loan can provide you with the money to fund an experience that is personally rewarding through providing some memories of a lifetime. An around the world cruise may seem out of reach in terms of cost, but if you know that you have a steady income that isn’t likely to decrease in the near future it could be a life enriching experience well worth doing and with manageable payments each month to pay off the loan it doesn’t have to be such a large or unattainable financial outlay.

It could even be used to realise your personal goals, a wedding, special celebrations or even cosmetic surgery to keep your youthful looks and figure.

Whilst the uses of a large loans are many and varied, it is essential to make sure you are getting a loan that will in some way benefit you either financially, or meet an important goal you have set on a personal level. The key to this is seeking out a reputable established loan company who can tell you some of your options and provide you with the necessary guidance and tools to make an informed decision. First Choice Finance have been helping people raise larger amounts of money when they need it for around 25 years. To find out more on our long term large loan range visit www.Firstchoicefinance.co.uk .

Don’t rush into any decision when it comes to your finances especially when borrowing larger amounts, think prudently and discuss your options with an experienced finance adviser and any other parties involved to ensure that above all you come out achieving what you set out to do in a way that is affordable.

the loan market and the huge variety of differing products on offer cause it to be a notoriously difficult field to navigate. When you are looking for larger amounts of above £10,000 the options are more limited so get the right loan and the success story will be evident, choose the wrong type, or term of the loan and it can put a person in a worse financial situation than when they initially started out.

The repayment term for the loan can weigh heavily on whether it is affordable and thus whether the loan is the right move for a person. This is more of a factor with larger amounts as the payments may just be too much to cope with over a just a few years.

For some of us, a long term loan could constitute a personal loan repaid over two or three years and so compared to a payday loan that should be repaid only weeks after you take out the loan, it could be considered long term. Generally though, a long term loan would be some type of secured loan or mortgage that can allow a repayment term of up to 35yrs - as long as it fits with other criteria stipulated by the lender. By having a longer term to repay your loan the repayments can be decreased and you can hopefully afford to raise the larger amount that you require for your scenario.

There are a number of secured loan products available but opting for a loan type, like an `any purpose loan` widens your horizon on the uses of long term loans and often allows you to utilise the capital raising in more efficient ways.

Secured loan volume in the UK has recovered slightly over the last year or so and is probably nearing the £50 million pounds a month, so consumers are using this type of loan to get the money they require. Secured loans on average are larger than unsecured loans, so less actual loans will see more volume of money being lent.

So if you are going to look into secured loans what exactly can they be used for?

Enhancing your home through a new bathroom, kitchen, conservatory or a makeover is one well know use of large secured loans. The fact is in modern times these home improvement projects are expensive and so being able to spread the cost over longer periods may make your project viable.

Raising money for debt consolidation is often a popular use, if you have numerous high interest credit cards weighing down on your household finances; it is easy to let the debt escalate, especially if you can only maintain the minimum payment on each loan. By taking out a larger long term loan you can spread the payments over an affordable term and actually start to cut down on your monthly outgoings, the key thing is to put yourself in a better cash flow position.

Aside from refinancing or extending your house, a large loan can provide you with the money to fund an experience that is personally rewarding through providing some memories of a lifetime. An around the world cruise may seem out of reach in terms of cost, but if you know that you have a steady income that isn’t likely to decrease in the near future it could be a life enriching experience well worth doing and with manageable payments each month to pay off the loan it doesn’t have to be such a large or unattainable financial outlay.

It could even be used to realise your personal goals, a wedding, special celebrations or even cosmetic surgery to keep your youthful looks and figure.

Whilst the uses of a large loans are many and varied, it is essential to make sure you are getting a loan that will in some way benefit you either financially, or meet an important goal you have set on a personal level. The key to this is seeking out a reputable established loan company who can tell you some of your options and provide you with the necessary guidance and tools to make an informed decision. First Choice Finance have been helping people raise larger amounts of money when they need it for around 25 years. To find out more on our long term large loan range .

Don’t rush into any decision when it comes to your finances especially when borrowing larger amounts, think prudently and discuss your options with an experienced finance adviser and any other parties involved to ensure that above all you come out achieving what you set out to do in a way that is affordable.

|

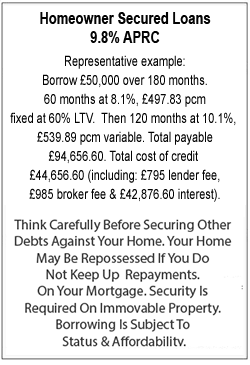

Homeowner Secured Loans |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential