|

|  |

|

|  |

|  |

Borrow £1000 Or £500 to £10,000.

Unsecured Personal & Guarantor Loan Plans.

No Obligation & Free Quotes.

Use The £1000 You Obtain For Any Purpose.

A bad credit rating may impact the availability of loans for you but there may still be loan plans available for you. If you have been unfortunate to have missed mortgage payments, have CCJs or missed payments on other existing debt you may find that you have a bad credit rating. To see what loan options we have available for you please complete our short on line enquiry form. The £1000 you obtain can be used for pretty much any (legal!) purpose you desire, common uses are a holiday, new furniture, garden equipment or even a run about car.

Some different loan types may well be more suited to you for £1,000 if you have bad credit such as;

Guarantor Loans For Bad Credit - If you have difficulty finding credit an alternative loan that is becoming increasingly popular is a guarantor loan, this is where you take out a loan but you require a friend, relative or colleague as a guarantor, they help to ensure that you will keep up the repayments and if you are unable to, they agree to pay the debt instead. Guarantor loans are becoming increasingly popular for loans around a £1,000 up to £7,000, our maximum guarantor loan lenders plan has been increased from £10,000 to £12,000. Simply select guarantor loan from the product box when you enquire on line if you are interested in this loan.

they help to ensure that you will keep up the repayments and if you are unable to, they agree to pay the debt instead. Guarantor loans are becoming increasingly popular for loans around a £1,000 up to £7,000, our maximum guarantor loan lenders plan has been increased from £10,000 to £12,000. Simply select guarantor loan from the product box when you enquire on line if you are interested in this loan.

Unsecured Credit - Just because you have a bad credit rating doesn`t mean all the lender won`t lend to you. In fact you may even be able to find a credit card or an unsecured personal loan to raise £1,000 with your credit rating. Check you are happy with the rate before you accept any offer made and ensure you can afford the repayments as missing payments can be costly and restrict your access to credit or loans in the future.

First Choice Finance could help to give you a selection of loan options for people with bad credit, please enquire online or give us a call and speak to our finance team.

Unsecured personal loans or guarantor loans are a popular alternative to other forms of credit such as credit cards or payday loans.

Why you may wish to avoid payday loans - Payday loans can be a useful to get short term funding for an unexpected expense. But they can be charged at extremely high interest rates, 1000`s of percent. They have developed for short term lending for those who have bad credit ratings or a short term cash flow problem, many of us have found ourselves falling into the payday loan cycle of borrow, repay, borrow again. Unsecured personal loans can allow you to spread the payments over a longer period of time and give you structured repayments for your loan plan

Personal loans an alternative for credit card borrowing - Borrowing money on your credit card is for short term finance, many of us spend on our credit card and only repay the minimum amount repayable, resulting in slow repayment of the credit card debt, as they do not have the structure of a personal loan or a guarantor loan.

If you would like a relatively competitive rate for borrowing £1,000 even with an adverse credit rating First Choice Finance may be able to help you with arranging the finance that you need. You are not going to get head line rates if you are borrowing small amounts such as £1000 and you have bad credit but you may be surprised at the rate you get offered.

Secured Loans - As you have a bad credit rating you may not be able to find an unsecured loan, unfortunately secured loans are usually used for larger amounts over £1,000, with a minimum £5,000 but this does not mean you should dismiss them, if you have other outstanding debts (credit cards, existing loans, store cards) you could use a secured loan to consolidate them all into one, this could help you reduce your monthly outgoings and make your finances easier to manage with just one monthly repayment. However secured loans are secured on your home and you must be a homeowner, they also carry the same risks as a mortgage.

|

|

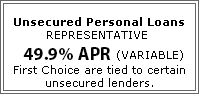

Unsecured Personal Loans |

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST

YOUR HOME. |

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Contact Us | About Us | Loan Companies | Privacy Policy | Site Map | Finance Videos | Finance Info

Need help? Just ask 0800 298 3000 or complete the short online enquiry form